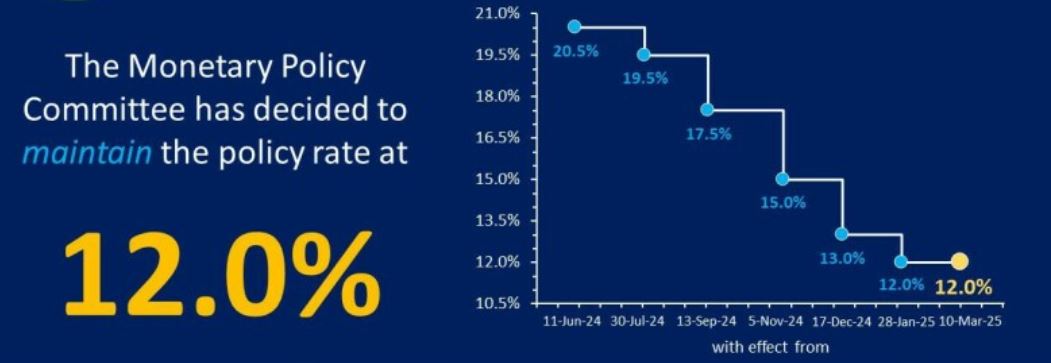

ISLAMABAD – State Bank of Pakistan decided to maintain the policy rate at 12percent, contrary to market expectations that a reduction was imminent.

In a statement released after the meeting, the central bank said MPC Monetary Policy Committee (MPC) decided to keep the policy rate unchanged at 12%

Leading up to the MPC’s decision, most market analysts had anticipated that the central bank would continue its trend of easing monetary policy, driven by a falling inflation rate.

Policy Rate in Pakistan

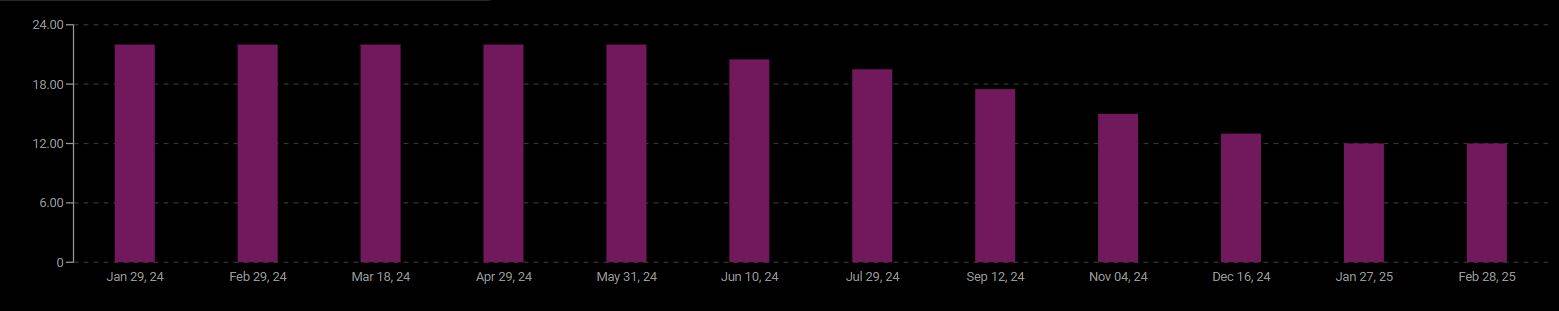

In a statement released after key meeting, State Bank highlighted that inflation in February 2025 was lower than expected, driven by a drop in food and energy prices. However, core inflation remains elevated and persistent, signaling ongoing challenges in managing price stability.

State Bank further noted that while economic activity continues to show positive signs, with high-frequency economic indicators and recent surveys reflecting improved consumer and business confidence, external pressures are mounting. Rising imports and weak financial inflows have led to some strain on the external account.

Interest Rate in Pakistan

The central bank emphasized that the effects of previous policy rate cuts are now beginning to materialize. Despite the positive outlook for economic growth, the SBP stressed the importance of maintaining a cautious monetary policy stance. This approach aims to stabilize inflation within the target range of 5-7% and ensure macroeconomic stability, while supporting sustainable growth in the medium term.

The decision comes as the SBP seeks to balance inflation control with economic expansion, amid a challenging global and domestic economic environment.

Pakistan’s Inflation eases to 1.5pc in Feb’25 amid economic revival