ISLAMABAD – A Withholding tax rate of 30% has been set on profit earned from National Saving Schemes for individuals who are not listed on the Active Taxpayers List of the Federal Board of Revenue (FBR) as per Central Directorate of National Savings (CDNS) update.

If someone is a Non-Filer and is not considered an active taxpayer, nearly one-third of their profit from savings schemes will be deducted as tax. In contrast, individuals who are taxpayers and file their tax returns will be charged meagre withholding tax rate of 15pc. Central Directorate of National Savings (CDNS) announced major policy revision, introducing a 30% withholding tax on profits and tax rate will come into force starting July 1, 2025.

Returns on Bahbood Savings Certificates

| Category | Amount |

|---|---|

| Investment | 100,000 |

| Gross Profit | 13,200 |

| Filer | |

| Withholding Tax (15%) | 1,980 |

| Net Profit (Filer) | 11,220 |

| Non-Filer | |

| Withholding Tax (30%) | 3,960 |

| Net Profit (Non-Filer) | 9,240 |

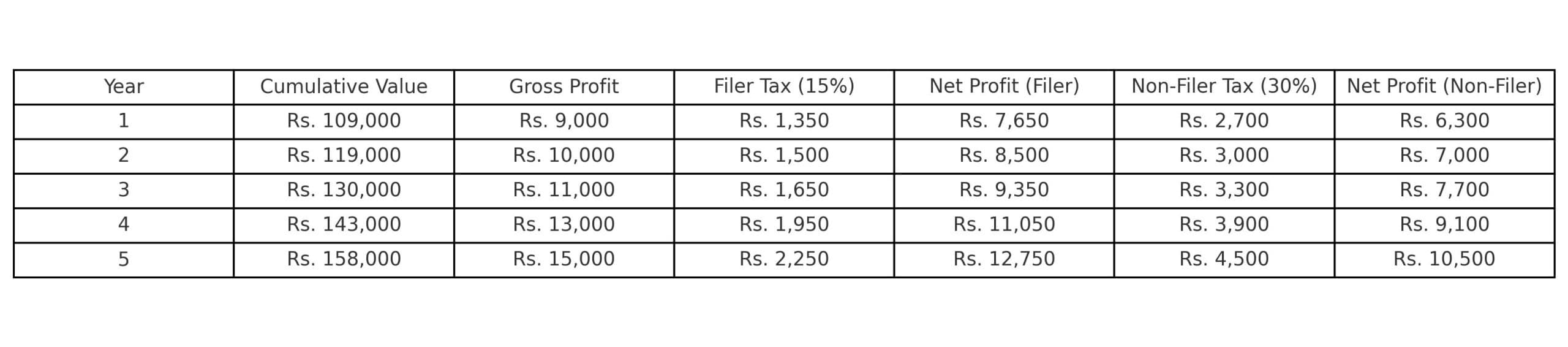

Defence Savings New Profit Rates 2025

Qaumi Bachat Bank has fixed the long-term investment profit rate at 11.19% for a 10-year period. According to the latest figures, a Rs. 100,000 investment under this scheme would yield the following cumulative returns:

-

After 1 year: Rs. 109,000

-

After 2 years: Rs. 119,000

-

After 3 years: Rs. 130,000

-

After 4 years: Rs. 143,000

-

After 5 years: Rs. 158,000

In addition to the tax update, CDNS has revised the profit structure for its savings instruments. Effective from June 27, 2025, Bahbood Savings Certificates will offer a monthly return of Rs. 1,100 on every Rs. 100,000 invested, reflecting an annual return rate of 13.20%.

CDNS move aims to balance attractive savings opportunities for compliant taxpayers while tightening regulations for non-filers.

Defence Savings Certificates profit rates 2025 update ahead of FY2026