Is the Federal Board of Revenue (FBR) Pakistan’s best-performing government institution? Consider this: Islamabad is home to over three dozen federal ministries, four dozen divisions, and nearly 400 departments.

Yet, unlike the FBR, most of these entities lack clear performance metrics—such as revenue collection—that allow for measurable accountability.

The numbers speak volumes. In 2010, the FBR collected Rs1.1 trillion in taxes. Last year, it brought in an impressive Rs11.7 trillion—reflecting a compound annual growth rate of 17 percent. This isn’t merely growth; it’s a performance leap that surpasses both inflation and GDP growth, underscoring the FBR’s relative efficiency compared to the three dozen federal ministries, four dozen divisions, and 400 departments.

From a qualitative standpoint, the Track and Trace System is helping curb tax evasion in sectors like tobacco. POS integration enables real-time sales tax collection from retailers. Digital platforms such as IRIS are streamlining tax filing and improving compliance. Notably, the number of taxpayers has grown from 1 million in 2009 to over 3 million today.

Critics point to corruption. Critics highlight missed targets. Let’s be honest: which of Pakistan’s 400 government departments is immune to corruption? From ministries to local offices, inefficiencies persist across the board. Let’s be honest: FBR stands out for its tangible results-17 percent compound annual growth.

As for missed targets, critics conveniently ignore context. FBR’s goals are set ambitiously high—often at the IMF’s insistence—to push the boundaries of revenue collection in a cash-heavy, informal economy. Missing some targets doesn’t negate FBR’s stellar 17 percent compound annual growth rate. Missing some targets doesn’t negate collections from Rs1.1 trillion 16 years ago to Rs11.7 trillion in 2024–25.Yes, this growth outstrips inflation and GDP, a feat unmatched by any other department. Yes, flaws exist, but FBR’s progress sets a benchmark no other department can rival.

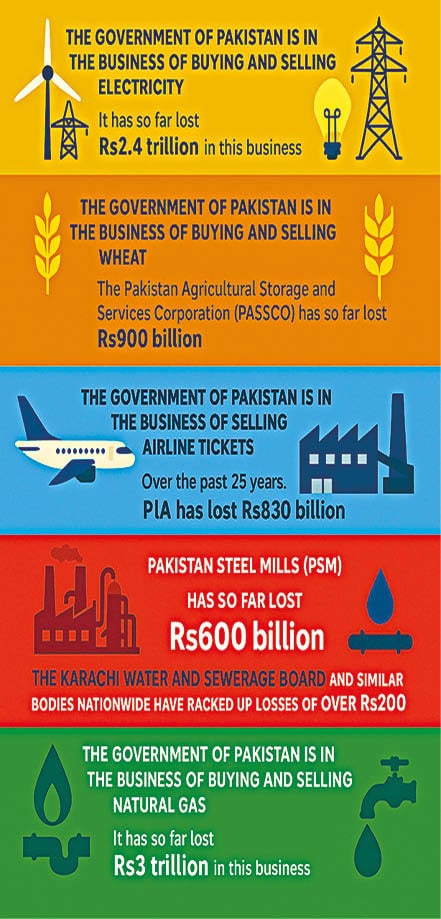

So what, then, is the federal government’s fiscal crisis really about? What’s the true ailment? Unless the disease is diagnosed accurately, the patient doesn’t stand a chance. Let’s look at the numbers: Rs2.4 trillion lost in electricity, Rs900 billion in wheat through PASSCO, Rs830 billion down the drain with PIA, Rs600 billion sunk by Pakistan Steel Mills, Rs200 billion wasted by water boards, and Rs3 trillion gone in natural gas. These aren’t just losses—they’re symptoms of chronic mismanagement. The problem isn’t a shortage of revenue. The problem is a government bleeding trillions through incompetence.

What then is the way out? the government must diagnose the true ailment: its own losses. The government must unlock fiscal health. The government must streamline its own operations. The government must divest failing so-called State Owned Enterprises.

Pakistan’s fiscal crisis isn’t about insufficient taxes—it’s about why we tolerate trillion-rupee losses in government enterprises. Excessive taxation stifles growth, burdens businesses, and discourages investment, slowing the economy just when Pakistan needs to grow. Consider the numbers once again: Rs2.4 trillion lost in electricity, Rs900 billion in wheat via PASSCO, Rs830 billion by PIA, Rs600 billion by Pakistan Steel Mills, Rs200 billion by water boards, and Rs3 trillion in natural gas. These aren’t just losses; they’re a betrayal of public trust, draining resources that could fund schools, hospitals, or infrastructure.

The question isn’t higher taxes – it’s why we tolerate trillion-rupee losses. Remember, taxes kill growth.