KARACHI – Sigh of relief for salaried individuals in Pakistan as federal government unveiled Budget 2025-26, with significant reductions in income tax rates and slabs.

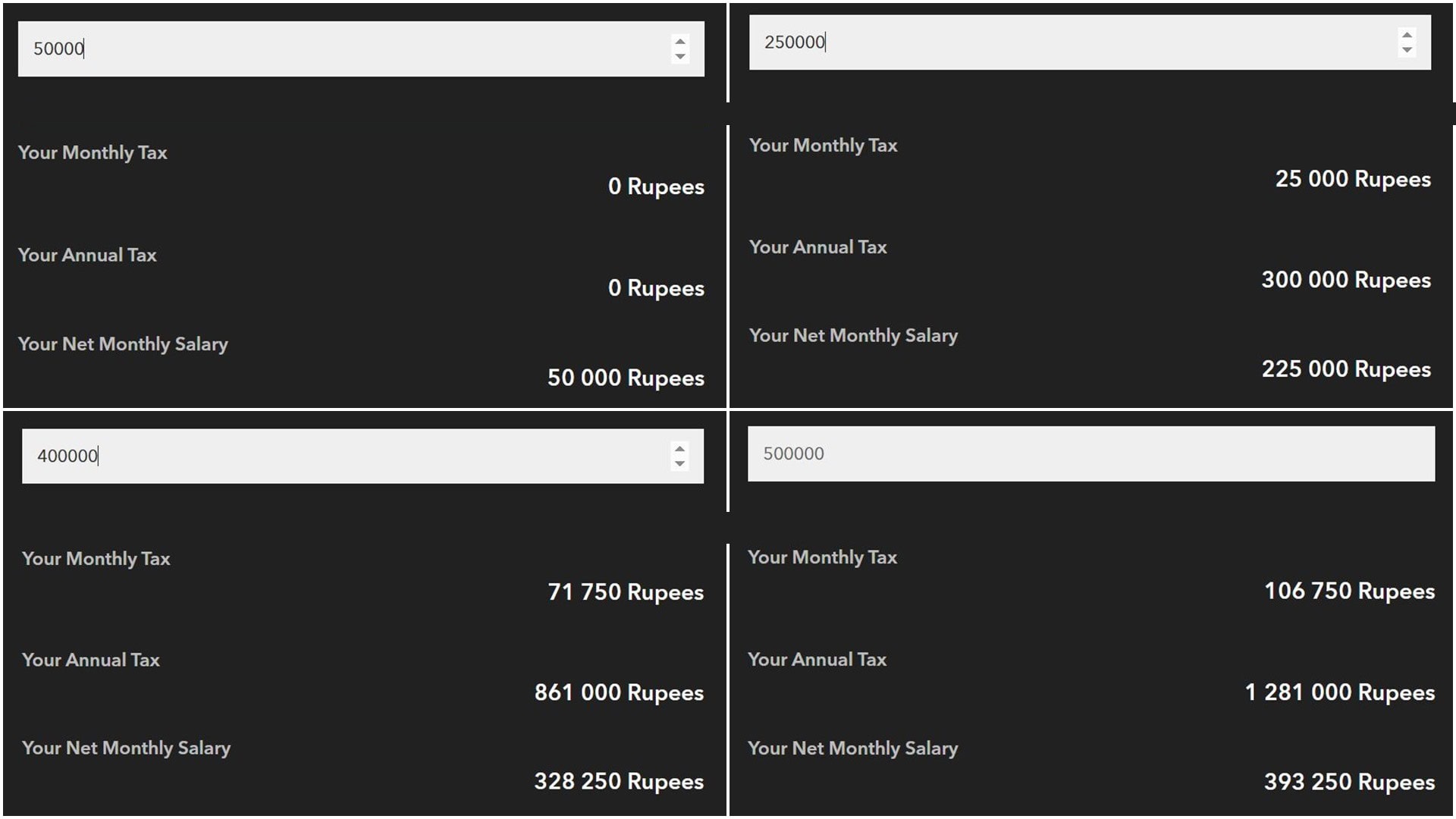

The new measures aim to ease tax burden on middle and lower-income earners, in boost to economic growth and increase in income. Under the proposed reforms, individuals earning up to 6Lac annually will see their tax rate slashed from 5% to just 1%. Those earning between 600,001 and 1,200,000 will benefit from the same reduction, lowering their tax liabilities.

Income Tax Slabs 2025

For taxpayers earning up to 1.2 million, the minimum tax payable is set to decrease from less than 30,000 to approximately 6,000, providing immediate relief.

Tax Slabs in Pakistan

| Income Bracket (Annual Salary) | Proposed Tax Rate |

| Up to 600,000 | 1% |

| 600,001 – 1,200,000 | 1% |

| Up to 1,200,000 | 6,000 (approx.) |

| Up to 2,200,000 | 11% |

| 2,200,001 – 3,200,000 | 23% |

Higher income brackets also receive favorable adjustments, with the tax rate for earners between 2.2 million and 3.2 million PKR dropping from 25% to 23%. These changes are designed to promote fairness and incentivize compliance among higher earners.

Finance Minister [Name] stated, “Our goal is to make the tax system more equitable and supportive of the hardworking citizens of Pakistan. These reductions will boost consumer spending and stimulate economic activity across sectors.”

These tax reforms will improve disposable income for millions of Pakistanis, potentially leading to higher consumption and investment.