KARACHI – National Savings Division updated profit rates on several investment options aimed at providing safe and stable returns to individuals, especially retirees, senior citizens, and low-risk investors.

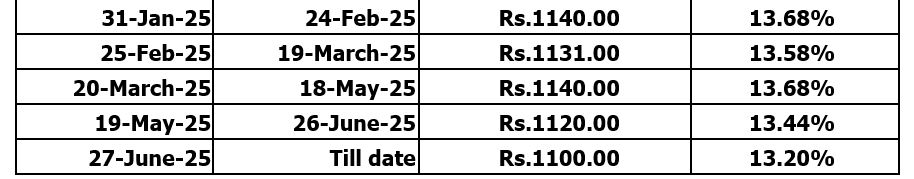

Among the options, the highest current rates 13.20pc are being offered on Pensioners Benefit Account, Behbood Saving Certificate, and Shuhda Family Welfare Account. These schemes are specifically designed to support pensioners, widows, and families of martyrs. Defence Savings Certificate and Regular Income Certificate now offer 11.76% and 11.16%, showing downward revision in rates.

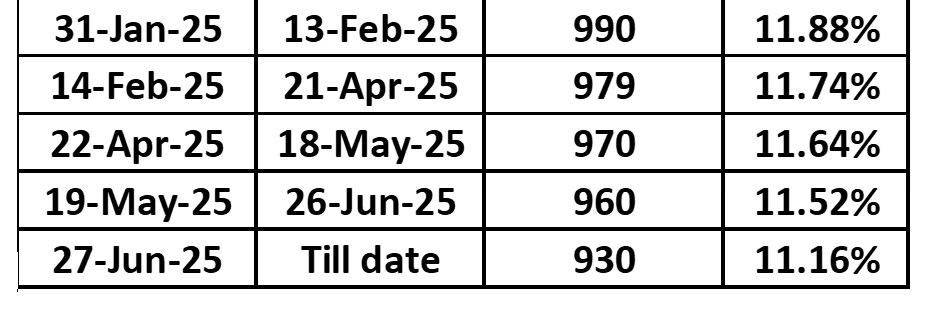

Saving Account rate remains unchanged at 9.50pc while Islamic investment options like Sarwa Islamic Term and Saving Accounts are now yielding 9.75pc, a notable decrease from their previous rates. Overall, this revision indicates a general decline in profit rates across most National Savings instruments.

| Investment Type | Rate |

|---|---|

| Special Saving Certificate | 10.60-10.90 |

| Defence Savings Certificate | 11.76 |

| Regular Income Certificate | 11.16 |

| Saving Account Rate | 9.50 |

| Pensioners Benefit Account | 13.20 |

| Behbood Saving Certificate | 13.20 |

| Shuhda Family Welfare Account | 13.20 |

| Sarwa Islamic Term Account | 9.75 |

| Sarwa Islamic Saving Account | 9.75 |

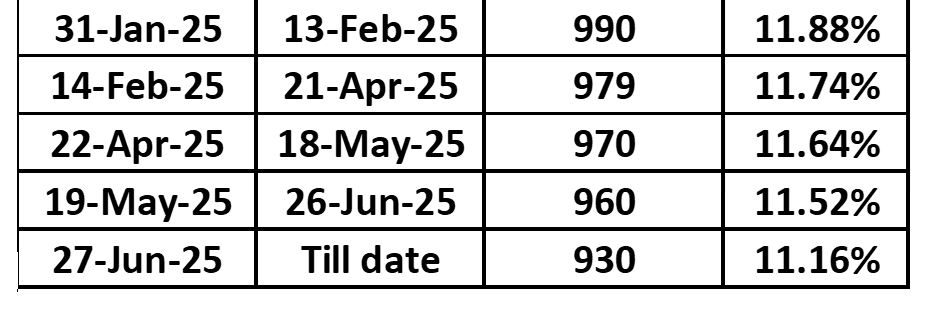

In a recent announcement, the government has revised profit rates on several National Savings Schemes (NSS), with new rates effective from June 27, 2025. The adjustments come amid ongoing economic shifts and aim to realign returns with the current interest rate environment.

Among the notable changes, the Shuhda Family Welfare Account, Pensioners Benefit Account, and Bahbood Savings Certificates have each seen a reduction of 24 basis points, lowering their returns to 13.20%. Defence Saving Certificates will now offer 11.76%, down from 11.91%. Meanwhile, the Saving Account rate remains steady at 9.50%

Behbood Saving Certificate

Regular Income Certificate

Short Term Saving Account Rate

Financial experts suggest that while the rate cuts could affect retirees and income-focused investors, these adjustments are part of broader fiscal efforts to maintain economic stability and manage public finances.