ISLAMABAD – Amid steps of widening tax base, Pakistani government intensified its fiscal pressure on non-filers, particularly those holding high-denomination prize bonds and earning from National Savings Schemes.

After fresh changes, the government doubled taxes on prize bond winnings and profit income for individuals not listed on the Federal Board of Revenue’s (FBR) Active Taxpayers List (ATL). Non-filers will now be charged 30pc tax on such earnings, twice 15pc rate applicable to compliant taxpayers.

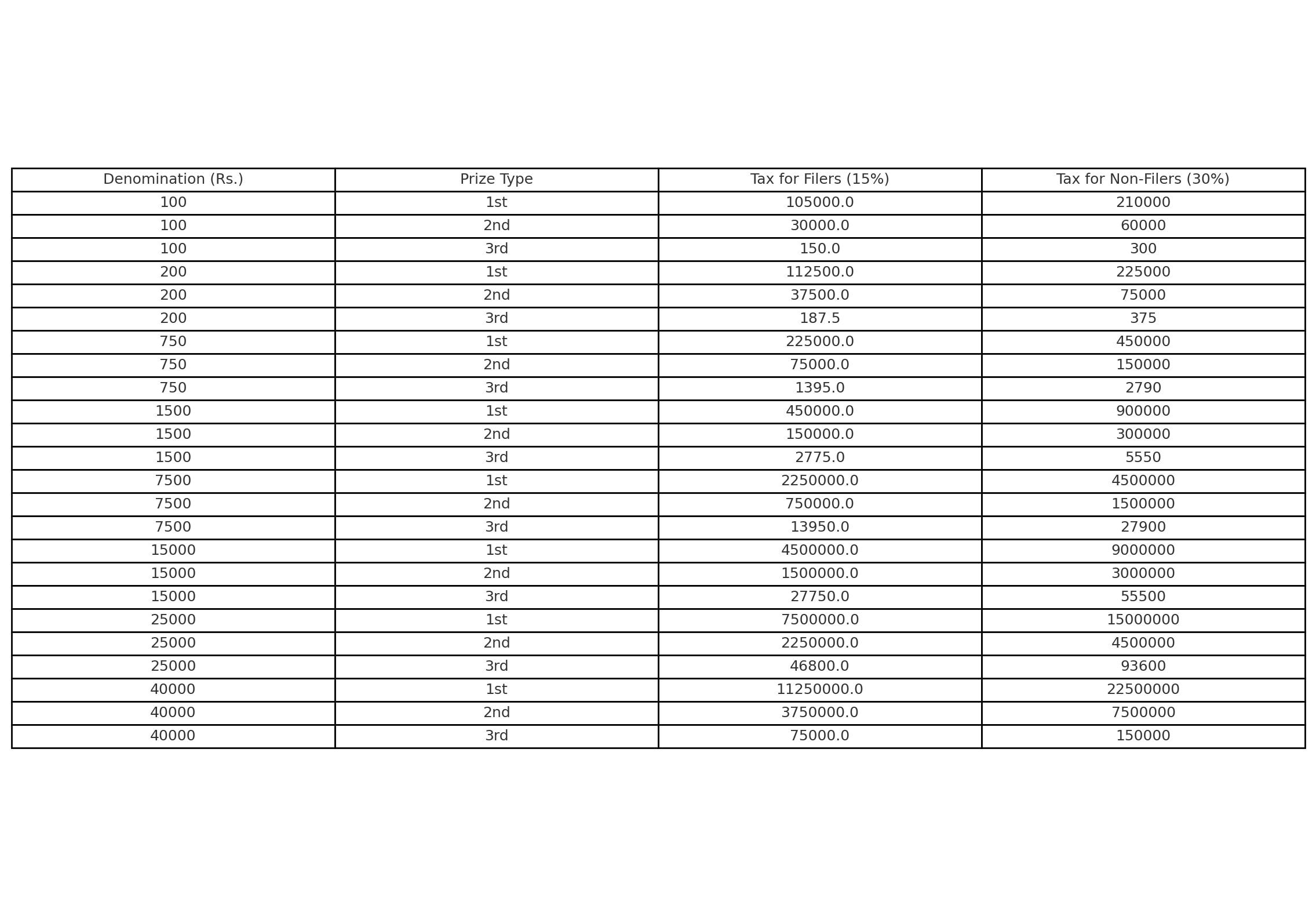

Taxes on Rs100 Prize Bond

| Prize Type | Prize | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 700,000 | 1 | 105,000 | 210,000 |

| 2nd | 200,000 | 3 | 30,000 | 60,000 |

| 3rd | 1,000 | 1,199 | 150 | 300 |

Rs. 200 Prize Bond

| Prize Type | Prize | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 750,000 | 1 | 112,500 | 225,000 |

| 2nd | 250,000 | 5 | 37,500 | 75,000 |

| 3rd | 1,250 | 2,394 | 187.50 | 375 |

Rs. 750 Prize Bond

| Prize Type | Prize | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 1,500,000 | 1 | 225,000 | 450,000 |

| 2nd | 500,000 | 3 | 75,000 | 150,000 |

| 3rd | 9,300 | 1,696 | 1,395 | 2,790 |

Rs. 1,500 Prize Bond

| Prize Type | Prize | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 3,000,000 | 1 | 450,000 | 900,000 |

| 2nd | 1,000,000 | 3 | 150,000 | 300,000 |

| 3rd | 18,500 | 1,696 | 2,775 | 5,550 |

Rs. 7,500 Prize Bond

| Prize Type | Prize Amount (Rs.) | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 15,000,000 | 1 | 2,250,000 | 4,500,000 |

| 2nd | 5,000,000 | 3 | 750,000 | 1,500,000 |

| 3rd | 93,000 | 1,696 | 13,950 | 27,900 |

Rs. 15,000 Prize Bond

| Prize Type | Prize | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 30,000,000 | 1 | 4,500,000 | 9,000,000 |

| 2nd | 10,000,000 | 3 | 1,500,000 | 3,000,000 |

| 3rd | 185,000 | 1,696 | 27,750 | 55,500 |

Rs. 25,000 Prize Bond

| Prize Type | Prize | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 50,000,000 | 1 | 7,500,000 | 15,000,000 |

| 2nd | 15,000,000 | 3 | 2,250,000 | 4,500,000 |

| 3rd | 312,000 | 1,696 | 46,800 | 93,600 |

Rs. 40,000 Prize Bond

| Prize Type | Prize Amount (Rs.) | No. of Prizes | Tax for Filers (15%) | Tax for Non-Filers (30%) |

| 1st | 75,000,000 | 1 | 11,250,000 | 22,500,000 |

| 2nd | 25,000,000 | 3 | 3,750,000 | 7,500,000 |

| 3rd | 500,000 | 1,696 | 75,000 | 150,000 |

The move is being seen as a clear message from the authorities: high-value prize bond holders who remain outside the tax system will no longer be allowed to benefit without contributing to the national exchequer.

“This step targets those sitting on large sums of untaxed money,” a senior tax official said. “People have long used premium prize bonds and savings instruments as a safe haven. That era is over.”

The higher tax also applies to profits from instruments such as Behbood Savings Certificates, Pensioners’ Benefit Accounts, and Defence Savings Certificates.