Umair Ahmad

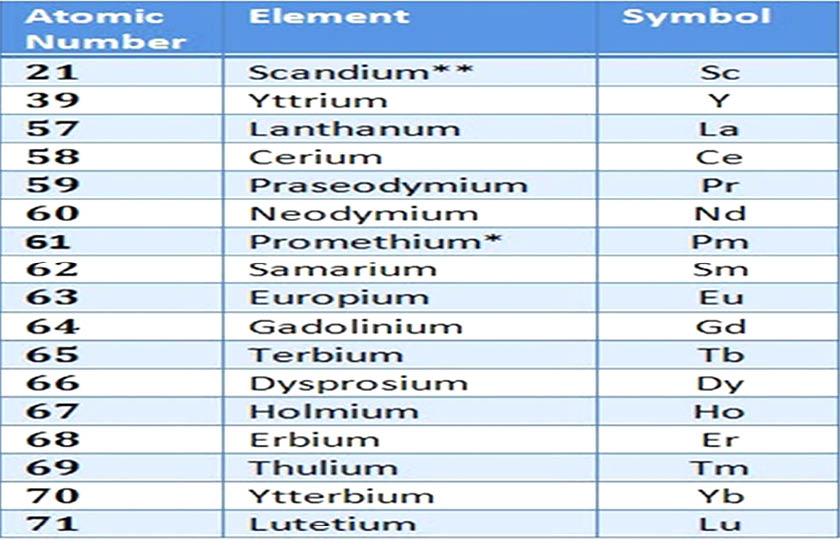

Rare Earth Metals/Minerals (REMs) are a group of 17 chemically similar elements that exhibit unique magnetic and conductive properties.

Despite their name, they are abundant in Earth’s crust but difficult to extract due to their low concentration, complex mining process, and environmental concerns. Because of their unique properties, they are irreplaceable.

There is fierce geopolitical competition among global powers, such as the United States (US) and China, to control the REMs supply chain, which would be pivotal for global dominance. This insight argues that the supply chain vulnerabilities of REMs play a crucial role in shaping geopolitical competition, while highlighting Pakistan’s standing in the realm of REMs and its response options.

REMs are indispensable in manufacturing modern technologies, including electronic and consumer products, renewable and clean energy, defence and aerospace, medical devices, and computing systems.

The demand for REMs surged during the Cold War, particularly in the aerospace and military sectors. In the 21st century, the horizon of these REMs has expanded even further, becoming the backbone of modern industries and humanity’s battle against climate change. These are used everywhere, from smartphones and wind turbines to advanced missiles and radars. The following is a list of all the REMs:

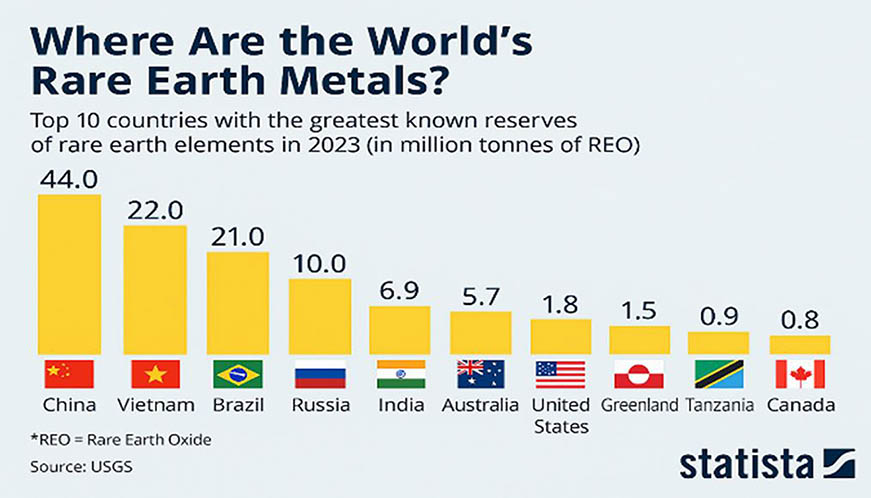

According to the US Geological Survey (USGS), which conducted a study in 2023, there are around 130 million tons of rare oxide ores worldwide. These REMs are unevenly distributed and concentrated in a handful of nations worldwide, making the supply chain more vulnerable to manipulation. The following graph visually represents the top 10 countries with REM deposits worldwide.

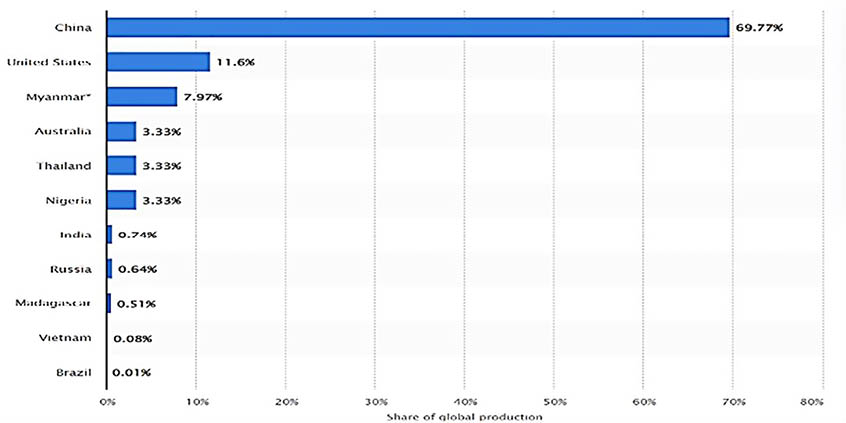

The REMs supply chain is a multistage process that includes mining, refining, and processing. Currently, China is leading in all stages with considerable margins. China holds the largest reserves of REMs (around 40% of Global deposits) and is responsible for around 70% of the annual global mining output. China also processes and refines around 90% of the world’s Rare Earth Oxide (REO).

Since the 1990s, China has placed a special focus on the mining sector, developing it as a strategic sector. This has enabled vertical integration in the REMs supply chain through indigenization and control of each step, providing a considerable strategic advantage.

Source: Thermo Fisher Scientific, All 17 Rare Earth Elements

Meanwhile, even advanced economies like the EU and the US have struggled to develop this sector due to high costs, environmental concerns, and a lack of proper infrastructure. Even the US sends most of its mined ore to China for refining and imports around 80% of its refined and processed rare earth metals (REM) supply from China, making its defense and tech sectors vulnerable. The following graph depicts the annual mining production in 2024 of REMs country-wise:

Currently, the US is attempting to diversify its supply of REMs and its allies, focusing on bypassing Chinese dominance by building infrastructure and alliances that enhance REMs’ supply chain resilience. To achieve this, the Mineral Security Partnership (MSP) was established in 2022 to diversify and secure the REMs supply chain. MSP has 23 member states as of yet, including the EU, Australia, Germany, France, and India. It is also reviving its domestic processing and refining capabilities, reopening its only REM mine in California in 2017 amid National security concerns. It aims to refine the mined ore from this site domestically, a process currently handled by China. Other initiatives include efforts like allocating funds for research on alternatives to REMs.

The mineral deal with Ukraine was also finalized on April 30, 2025, giving the US access to the vast, untapped reservoirs of REMs. Ukraine’s reserves contain 22 of the 33 minerals declared critical by the EU, making them extremely important strategically. The Trump administration has also repeatedly signaled its intention to acquire Greenland, thereby gaining control over its vast mineral reserves, including REM. These steps reflect broader attempts to restructure and secure critical global supply chains along geopolitical lines.

Source: Statista, Countries with the Greatest Known Reserves of Rare Earths

While no official reserve tonnage of REMs has been published, geological indicators and ongoing exploration projects by the Geological Survey of Pakistan (GSP) suggest a strong strategic potential. GSP studies and joint geochemical surveys with China confirm the presence of light rare earth elements (LREEs), such as cerium (Ce), lanthanum (La), neodymium (Nd), and praseodymium (Pr), primarily in the Skardu–Chilas region (Gilgit-Baltistan) and the Neelam Valley (Azad Kashmir). Khyber Pakhtunkhwa hosts REMs in Tarbela, Swat, and Buner. The Pothohar Plateau in Punjab also exhibits monazite-rich placer deposits in its rivers. In the south, Balochistan’s Makran coast and Chagai region reveal REM-bearing heavy sands and igneous zones. Additionally, Thar’s coal ash in Sindh is under assessment for extracting La and Ce.

According to Commerce Minister Jam Kamal, over 95% of Pakistan’s mineral wealth remains unexplored, with critical minerals such as REMs high on the national agenda. The latest Pakistan Mineral Investment Forum, held 8-9 April 2025, attracted international attention from the US, Saudi Arabia, and China.

Pakistan is actively exploring its REMs resource under the Ministry of Energy (Petroleum Division), with operational support from the Pakistan Mineral Development Corporation (PMDC) and GSP. Pakistan introduced a National Mineral Policy in 1995, which was last updated in 2013 and requires an update. However, a comprehensive policy specific to REMs is needed.

Pakistan holds a strategic advantage through its vast, untapped reserves of Rare Earth Metals (REMs), positioning it to establish critical partnerships with major global powers such as the US and China. As Pakistan negotiates with the U.S. on tariff relief (talks now increasingly tied to cooperation on critical minerals), it becomes evident that REMs are emerging as a key instrument of resource diplomacy.

Source: Statista, Mining of Rare Earths by Country

At the same time, China, as the global leader in REM mining and processing, presents an equally compelling partner for long-term collaboration.

Given the immense economic potential and geopolitical implications, Pakistan’s National Security Committee (NSC) should oversee the matter at the highest level, ensuring a strategic, state-led approach. Pakistan must handle this domain with calculated precision, leveraging REMs to secure maximum economic returns, invest in infrastructure, and elevate its geopolitical stature. Whether striking deals with the US or China, Pakistan’s goal should be clear: to extract the highest value while securing domestic development and maintaining strategic flexibility in dealing with the world’s major powers, thereby preserving its national interests.